The top choice to explore the world

Hotels

Flights

New! Whoosh

Trains

Bus & Travel

Airport Transfer

Car Rental

Things to Do

More

One-way / Round-trip

Multi-city

1 Adult, 0 Child, 0 Infant (on lap)

Economy

Looking for

Discover Flight Ideas

Price Alert

10% New User Coupons

Valid for First Transaction on Traveloka App

Save up to 10% for Your First Hotel Booking

Valid for New Users in App Only

JALANYUK

Copy

Save up to 10% for Your First Attractions Booking

Valid for New Users in App Only

JALANYUK

Copy

Save up to 12% for Your First Airport Transfer Booking

Valid for New Users in App Only

JALANYUK

Copy

Save up to 10% for Your First Car Rental Booking

Valid for New Users in App Only

JALANYUK

Copy

Save Rp 25.000 For Your First Bus Booking

Valid for New Users in App Only

JALANYUK

Copy

Save Rp 10.000 For Your First Shuttle Booking

Valid for New Users in App Only

JALANYUK

Copy

Enhance your trip the way you like it

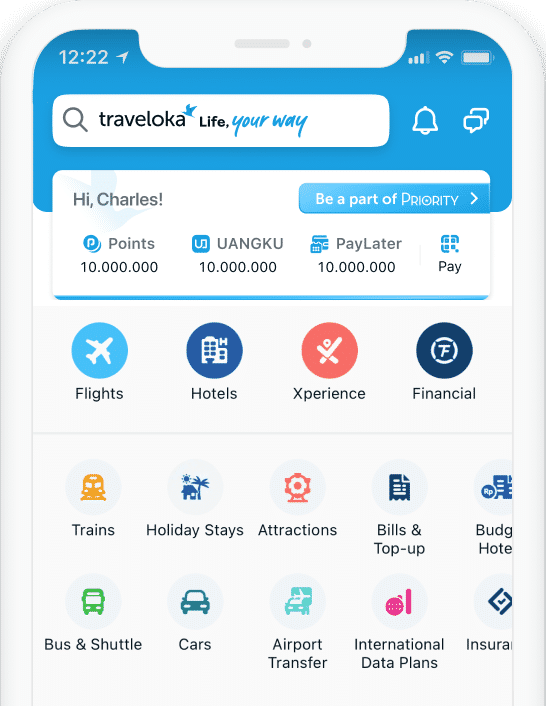

Why book with Traveloka?

50M+ Downloads,

1M+ Reviews

4.6

4.7

Download Traveloka App

App-only deals

Unlock special prices and exclusive app discounts.

Easy refund & reschedule

Adjust your plans with ease, even on the move.

Instant notifications & alerts

Get notified about flight changes and important trip updates.

What interests you?

Popular Flight

Popular Hotel

Popular Activities

Other Popular Products

Tiket Pesawat

Tiket Pesawat ke Bali

Tiket Pesawat ke Singapore

Tiket Pesawat ke Lombok

Tiket Pesawat ke Jakarta

Tiket Pesawat ke Surabaya

Tiket Pesawat ke Kuala Lumpur

Tiket Pesawat ke Malang

Tiket Pesawat ke Medan

Tiket Pesawat ke Jogja

Tiket Pesawat ke Bangkok

Tiket Pesawat ke Hong Kong

Tiket Pesawat ke Semarang

Tiket Pesawat ke Belitung/Tanjung Pandan

Tiket Pesawat ke Malaysia

Tiket Pesawat ke Vietnam

Tiket Pesawat Jakarta-Bali

Tiket Pesawat Jakarta-Padang

Tiket Pesawat Jakarta-Surabaya

Tiket Pesawat Jakarta-Makassar

Tiket Pesawat Jakarta-Lombok

Tiket Pesawat Bali-Jakarta

Tiket Pesawat Balikpapan-Surabaya

Tiket Pesawat Jakarta-Pekanbaru

Tiket Pesawat Jakarta-Pontianak

Tiket Pesawat Jogja-Karimunjawa

Tiket Pesawat Semarang-Karimunjawa

Tiket Pesawat Surabaya-Balikpapan

Tiket Pesawat Surabaya-Bali

Tiket Pesawat Jakarta-Jayapura

Tiket Pesawat Jakarta-Batam

Tiket Pesawat Jakarta-Bandar Lampung

Tiket Pesawat Jakarta-Singapore

Tiket Pesawat Jakarta-Kuala Lumpur

Tiket Pesawat Jakarta-Bangkok

Tiket Pesawat Medan-Kuala Lumpur

Flight Radar

Lion Air

Pelita Air

Susi Air

Citilink

Batik Air

Air Asia

Emirates

Vietravel

KLM

Super Air Jet

Garuda Indonesia

Singapore Airlines

Malaysia Airlines

Japan Airlines

Etihad Airways

Bandara Soekarno-Hatta (CGK)

Bandara Silangit (DTB)

Bandara Yogyakarta International Airport (YIA)

Bandara Changi International Airport (SIN)

Products

Copyright © 2026 Traveloka. All rights reserved